Clinical demand for more precise diagnostics and treatment planning has become a defining force in the evolution of the dental imaging market. As procedures such as implant placement and aesthetic dentistry increasingly rely on detailed anatomical visualization, imaging technologies have moved from supportive tools to essential clinical infrastructure.

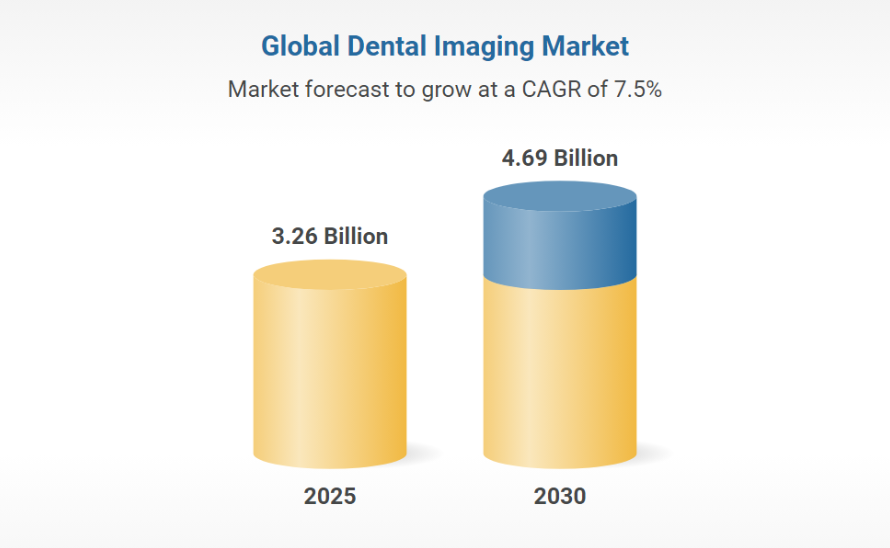

Alongside this shift, the global rise in dental caries and periodontal disease continues to expand the need for routine and advanced imaging. The growing popularity of dental tourism has further accelerated adoption, particularly in regions investing in modern diagnostic capabilities. As a result, the global dental imaging market is projected to grow from USD 3.26 billion in 2025 to USD 4.69 billion by 2030, reflecting a compound annual growth rate of 7.5% during the forecast period.

Technological progress remains a central growth enabler. Advances in three-dimensional imaging, combined with increasing demand for diagnostic accuracy and optimized treatment workflows, are reshaping purchasing decisions across dental institutions. In parallel, the wider availability of portable imaging solutions is improving access to dental care in remote regions and among patients with limited mobility, broadening the overall market base.

From a product perspective, extraoral imaging systems continue to represent the largest segment of the market. Within this category, 3D CBCT solutions are expected to demonstrate the strongest growth momentum, supported by their extensive use in implantology, endodontics, oral and maxillofacial surgery, and orthodontics for diagnosis, treatment planning, and post-treatment evaluation.

By application, implantology remains the dominant segment, driven by the ability of imaging technologies to support precise measurement, accurate implant placement, and comprehensive outcome assessment. In terms of end users, dental diagnostic centers account for the largest share of market demand, reflecting increased investment in advanced imaging systems, higher patient awareness, and the need for faster diagnostic turnaround.

Regionally, North America continues to lead the global dental imaging market, supported by strong R&D activity, early adoption of advanced imaging technologies, and sustained demand for cosmetic dentistry. Meanwhile, the Asia-Pacific region is expected to record the fastest growth rate over the forecast period, fueled by improving healthcare infrastructure, a growing base of regional manufacturers, and relatively flexible regulatory environments.

Key Players in the Global Dental Imaging Industry

Tier 1 (30%):

Envista Holdings Corporation (USA), Planmeca Oy (Finland), ACTEON (UK), Dentsply Sirona (USA), Carestream Dental LLC (USA), VATECH (South Korea), Owandy Radiology (France), DÜRR Dental AG (Germany)

Tier 2 (30%):

Midmark Corporation (USA), Shanghai Handy Medical Equipment Co., Ltd. (China), Genoray Co., Ltd. (South Korea), Asahi Roentgen Ind. Co., Ltd. (Japan), 3Shape A/S (Denmark), PreXion, Inc. (USA), Runyes Medical Instrument Co., Ltd. (China)

Tier 3 (40%):

Cefla S.C. (Italy), RAY Co. (South Korea), Yoshida Dental Mfg. Co., Ltd. (Japan), Align Technology, Inc. (USA), J. Morita Corp. (Japan), Xline S.r.l. (Italy)

Emerging Focus Brand in 2026: Handy Medical (Shanghai, China)

Handy Medical is committed to becoming a globally leading manufacturer of digital imaging products, providing the global dental market with a full range of intraoral digital imaging solutions and technical services centered on CMOS technology.

Its main products include digital intraoral X-ray imaging systems, dental phosphor plate scanners, intraoral cameras, and dental X-ray units. With outstanding product performance, stable quality, and professional technical support, Handy Medical has earned widespread recognition and trust from users worldwide, with products exported to numerous countries and regions.

Core Products

- HDR Series™ Digital Intraoral X-ray Imaging Systems:

FOP technology, resolution ≥27 lp/mm, wide dynamic range, long service life

- HDS Series™ Dental Phosphor Plate Scanners:

Compact and lightweight design, imaging time ≤6 seconds, compatible with four plate sizes

- HDI Series™ Intraoral Cameras

Focus range from 5 mm to infinity, broad clinical application coverage

- HandyDentist AI™ Software

Convenient and reliable, 5-second AI analysis, redefining the dentist–patient communication experience

Product Advantages

* China’s first precision manufacturer with CE, ISO, FDA, and NMPA certifications

* Global distributor management network

* Strong production capacity and after-sales service team

* Customized OEM solutions to support private branding needs

Key Figures

* HandyDentist used by over 40,000 clinics and hospitals worldwide

* 93 global agents

* Products sold in 120 countries and regions worldwide

* Over 10,000,000 images captured by users worldwide

Conclusion

Overall, the global intraoral digital imaging market shows strong growth potential heading into 2026. Development has moved beyond simple hardware upgrades toward clear trends of intelligence, digitization, and personalization. As a leading global brand with independent R&D and manufacturing capabilities, Handy Medical remains dedicated to the development and production of intraoral digital imaging products. In 2026, the company will further focus on enhancing accuracy and efficiency across diverse clinical scenarios through AI and customized OEM solutions. With excellent product performance, stable quality, and advanced technology, Handy Medical has earned broad trust and recognition from users worldwide.

Post time: Dec-25-2025